4-6%

Annual dividend growth

guidance through 2030

7.0%

5-Year Rate Base CAGR

$28.8B

2026-2030 Capital Plan

Annual dividend growth

guidance through 2030

5-Year Rate Base CAGR

2026-2030 Capital Plan

Fortis has nine regulated utilities in Canada, the U.S., and the Caribbean.

Our 9,900 employees serve 3.5 million electricity and natural gas customers.

Our regulated growth strategy is focused on providing safe, reliable and affordable service to our customers while supporting annual dividend growth

of 4-6% through 2030.

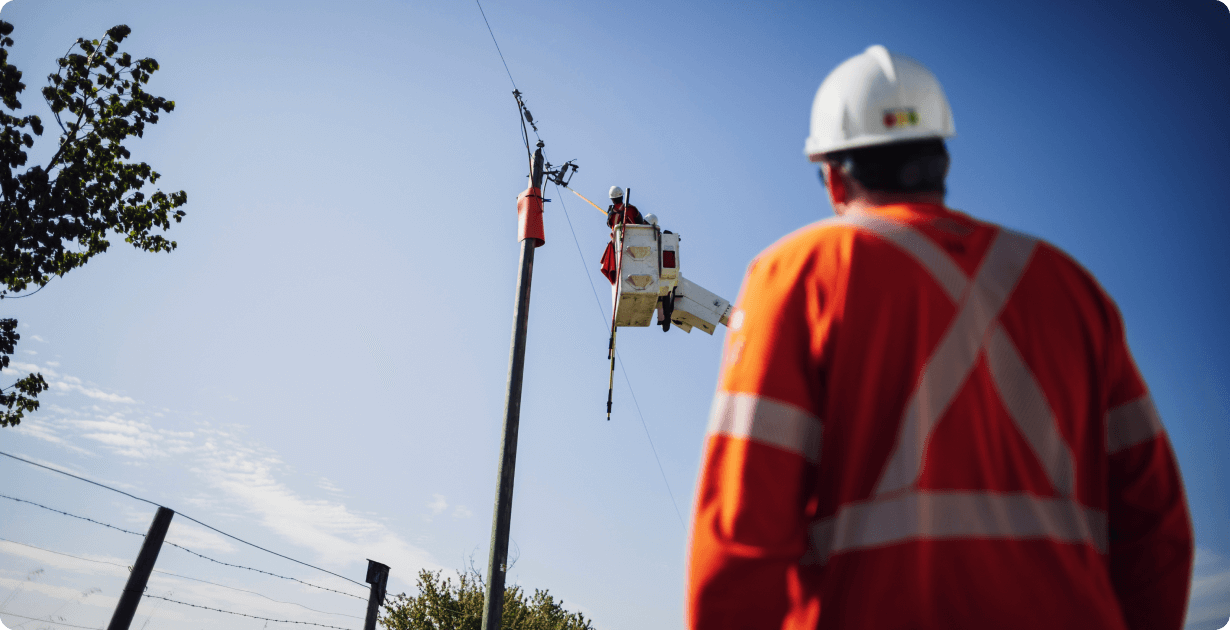

Safe, Well-Run Utilities

Strong Governance

Regulatory & Geographic Diversity

Constructive Regulatory Relationships

Local Business Model

100% Regulated

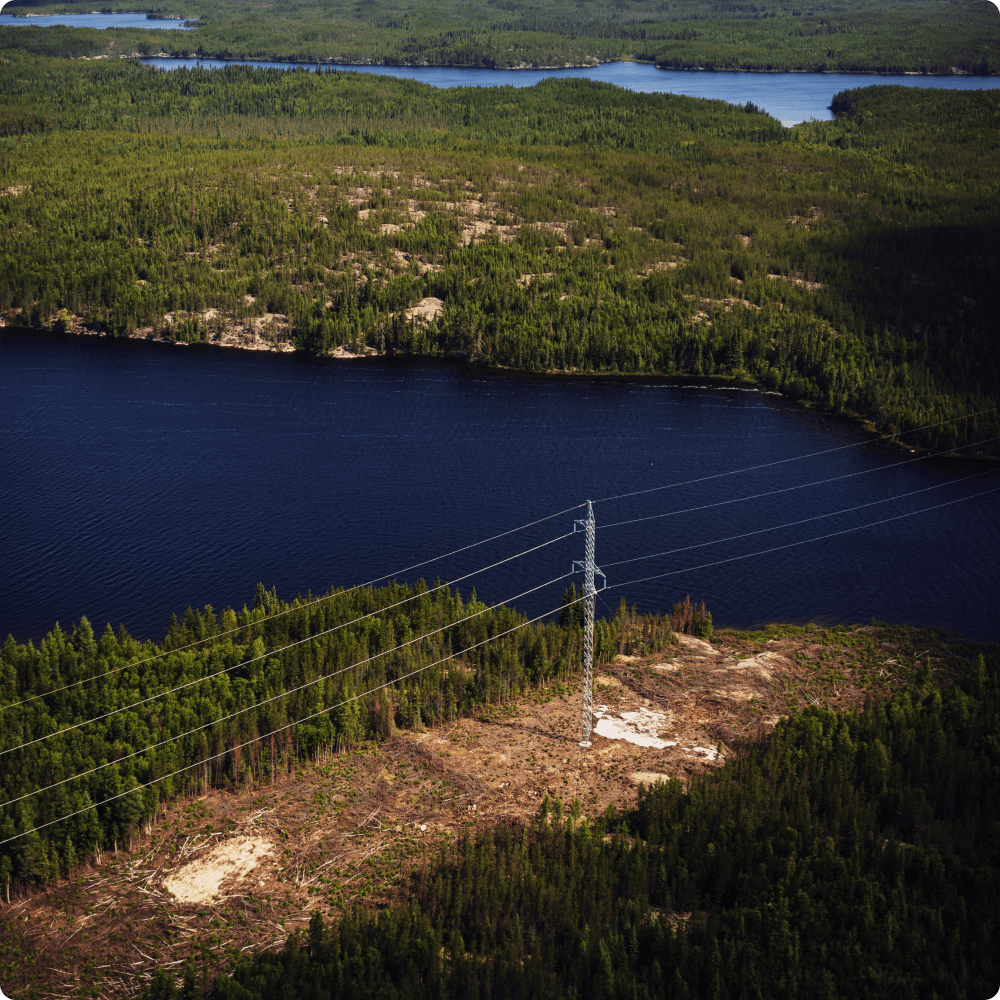

Primarily Transmission & Distribution Assets

Focused on Execution

Strong Rate Base Growth

Robust Transmission Investment Pipeline

Transparent Funding Plan

Cleaner Energy Transition

4-6% Annual Dividend Growth Through 2030

Investment-Grade Credit Ratings

Fortis has yielded a total annualized shareholder return of 9.5% over 20 years, or 517% in total.

Note: Cumulative 20-year total shareholder return as at December 31, 2025.

| 1-Year | 23.9% |

| 5-Year | 10.7% |

| 10-Year | 10.8% |

| 20-Year | 9.5% |

As at December 31, 2025

| $ millions, except as indicated | 2025 | 2024 | Variance |

|---|---|---|---|

| Common Equity Earnings | |||

| Actual | 1,714 | 1,606 | 108 |

| Adjusted (1) | 1,777 | 1,626 | 151 |

| Basic EPS ($) | |||

| Actual | 3.40 | 3.24 | 0.16 |

| Adjusted (1) | 3.53 | 3.28 | 0.25 |

| Dividends | |||

| Paid per common share ($) | 2.49 | 2.39 | 0.10 |

| Actual Payout Ratio (%) | 73.1 | 73.6 | (0.5) |

| Adjusted Payout Ratio (%) (1) | 70.4 | 72.7 | (2.3) |

| Weighted average number of common shares outstanding (# millions) | 503.5 | 495 | 8.5 |

| Operating Cash Flow | 4,062 | 3,882 | 180 |

| Capital expenditures (1) | 5,614 | 5.247 | 367 |

(1) Non-GAAP financial measure as disclosed in the Corporation's Annual Management Discussion and Analysis